Created in 2011 by SIDI and its partners, the Fefisol fund offers a technical assistance (TA) facility to African rural players, in addition to its financial support. After conducting nearly 140 TA projects on the continent, SIDI and Alterfin are due to launch a second fund in 2022, with the ambition of further deepening its social and environmental approach to the companies financed.

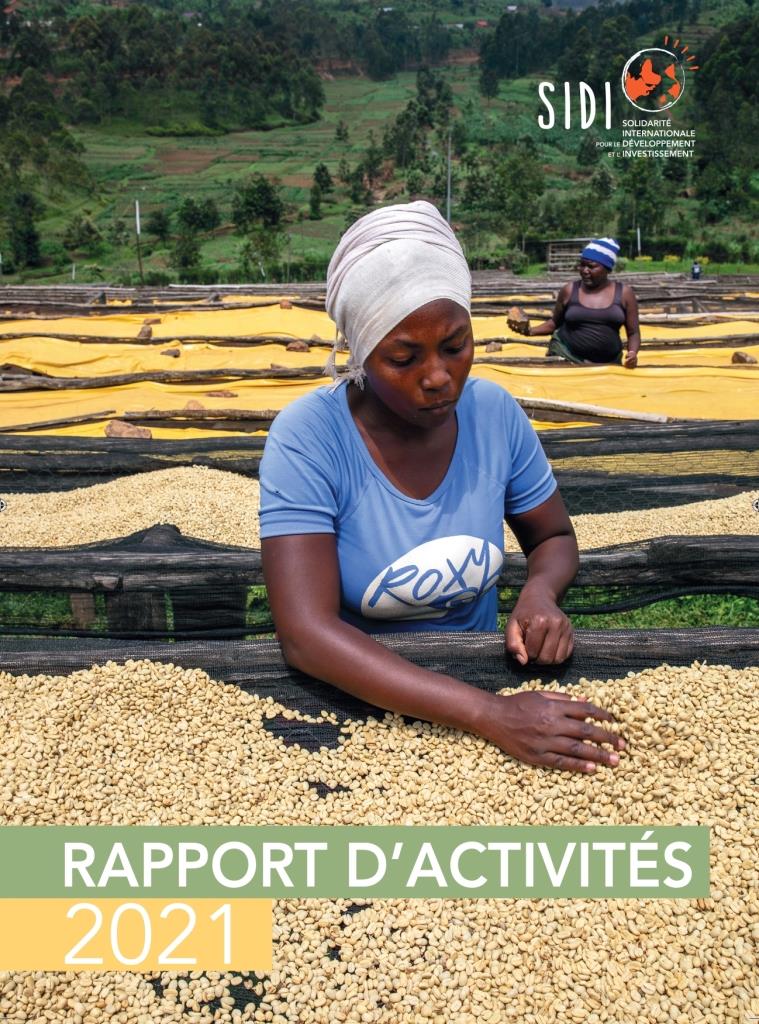

Financing and TA, fertile ground for the growth of agricultural entities in Africa

By Gabrielle Orliange, Head of Social and Environmental Performance SIDI/Fefisol (published in Secteur privé & développement #36, La revue de Proparco, 4th quarter 2021)

In Africa, microfinance and the rural sector are of little interest to the traditional banking system. However, technical support (TS) for agricultural entities, combined with appropriate financial services, play an essential role in the continent’s sustainable development. This is why the Fefisol fund (Fonds européen de financement solidaire pour l’AFrique), in addition to its financial support, offers a technical assistance facility to rural players. In this context, it provides its customers with specialized service providers who help them to strengthen their viability and improve their productivity, while preserving the living conditions of small-scale agricultural producers.

Since its creation just ten years ago, Fefisol has financed 139 support projects for 51 customers in 22 African countries. Over two-thirds of beneficiaries are small microfinance institutions (MFIs) undergoing consolidation[1] or agricultural entities. A quarter of the technical support projects supported by the fund relate to financial issues, in particular accounting monitoring and strengthening internal control.

The technical support program reinforces the impact of financial support. At the beneficiary level, the two levers of action are complementary: Fefisol loans enable companies to grow their business, while technical expertise helps them secure this growth by improving their efficiency. In terms of fund management, technical support in return enables investment managers to improve their understanding of how investee companies operate, thus guaranteeing greater operational efficiency.

Fefisol’s TA offer stands out above the rest by providing a tailor-made response to customer needs. The customer is heavily involved in the entire process, including the selection of the service provider. This sense of ownership is also reinforced by the direct financial contribution that each customer must make to the project[2].

INVOLVE THE CUSTOMER IN ALL PHASES OF THE PROCESS

Over the decade, the needs of Fefisol’s customers have changed considerably. For almost two years now, due to the economic crisis linked to the Covid-19 pandemic, requests to the fund have mainly been for equipment coverage not provided for in their annual budgets. For their part, MFIs have asked for support in managing liquidity in a crisis context. Fefisol has responded to this need by organizing, with partners, an online training course on this topic.

The independent evaluation of the facility in 2019 will assess the impact of technical support on beneficiaries. Many TA missions respond to opportunities and needs for fundamental change within beneficiary institutions. In many cases, TA projects have helped to kick-start an in-depth transformation process. By enabling customers to test innovations more quickly and easily, they help speed up the implementation of optimal solutions.

Several lessons can be drawn from these ten years of activity. The main one remains the need for the customer to take ownership of the technical support project. As such, his involvement in the process is crucial, from defining his needs for a customized solution to managing the consultant. It is also important to maintain a certain degree of agility throughout the implementation of TA projects, to ensure an effective response.

MEETING THE CHALLENGE OF PROJECT IMPACT ASSESSMENT

Downstream, the major challenge of this type of scheme remains that of evaluating the impact of TA programs on beneficiaries. Thanks to the possibility of granting successive financing and to its processes for monitoring the performance of its customers, Fefisol nevertheless has powerful tools for characterizing and documenting this impact over time.

To support this ramp-up, a Fefisol 2 fund will be launched in March 2022. Following on from Fefisol 1, it will continue to offer financial and technical services to rural MFIs and agricultural entities, with the ambition of deepening its social and environmental approach to projects. As such, the AT facility will have a compartment dedicated to improving sustainable agricultural practices and financing agriculture, while retaining its “tailor-made” approach so as to meet all its customers’ needs.

[1 ] Tier 3 MFIs, with total assets of less than USD 5 million.

[2 ] This mandatory contribution – at least 15% of each mission – explains the relatively low average value of TA projects.