The Farmer Thriving Index, a new initiative designed to better assess changes in the lives of small-scale farmers.

The Farmer Thriving Index (FTI) was created by 60Decibels, a company specializing in social impact measurement. The FTI is an assessment designed to better understand the changes brought about by cooperatives for their members, as perceived by small-scale agricultural producers themselves. It takes into account several dimensions of economic, social and environmental well-being, providing an overall assessment of their quality of life and the sustainability of their activities.

In East Africa, the FTI has focused specifically on small-scale coffee growers. A control group of 1,026 small-scale producers not affiliated to any cooperative or agricultural enterprise was interviewed. Their situations and responses are then compared with those of cooperative coffee growers.

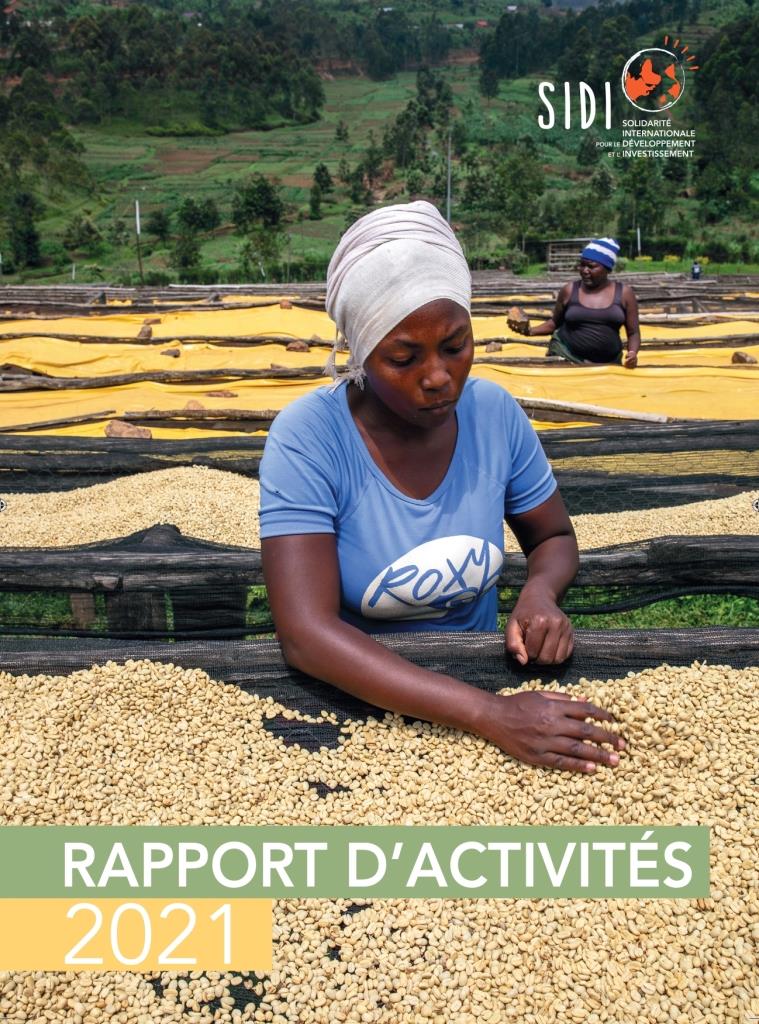

SIDI contributed to this study by co-financing, with our partner Aceli Africa and the ACTES foundation, an assessment of the situation of small-scale coffee producers who are members of Abakundakawa, a cooperative located in the north of Rwanda in the poor regions of Rushashi and Minazi. In all, 282 Abakundakawa suppliers were interviewed to better understand their situation and the effects of cooperative membership on their lives.

Abakundakawa, a Rwandan cooperative supported for over ten years by SIDI

Abakundakawa is a producer organization created in 1999 on the initiative of 367 Rwandan coffee growers, with the aim of enhancing the value of their production. From the outset, the organization has been dedicated to purchasing and processing Arabica coffee cherries into high-quality green coffee for international marketing.

Over the past 25 years, Abakundakawa has gone from strength to strength, and today boasts over 2,100 active members, 44% of whom are women, 23 permanent employees and 175 seasonal workers. It exports around 19 containers of coffee every year. Abakundakawa’s activities have a strong social mission. Indeed, improving the standard of living of its members is at the heart of the cooperative’s activity. To meet this objective, it charges purchase prices higher than the minimum price set by the government. In particular, the organization has been Fair Trade certified since 2005, and has thus been able to increase its impact on local social development through projects to supply water, improve agricultural access, pay for mutual health insurance schemes, and so on.

The study describes producers whose living conditions are particularly fragile

Two-thirds of the producers who responded to the survey are men, owners of their own land, with an average age of 48. The families are large and poorly educated; for 37%, elementary school is the highest level of education in the family. On average, they own 2.7 hectares of land, 44% of which is devoted to growing Arabica for export, the rest to peas, corn and bananas.For half of those interviewed, coffee production is their main source of income. An assessment of their behavior shows that 60% of respondents have incomes below the “Living Income Reference Value”, an estimate of the minimum amount needed to live decently in the region. However, almost all the farmers interviewed want to continue producing coffee, and hope that their children will too.

What Abakundakawa brings to its producers

The cooperative strives to build member loyalty through regular training by agronomists and field agents: 71% are in regular contact with these agents, whom they meet three times a year on average. What’s more, the interviewees’ farming practices are generally more virtuous than those of the control group, with all of them implementing good farming practices and two-thirds practicing agroforestry. Abakundakawa facilitates access to suitable tools (hoe, saw, pruning shears) and cows to promote natural fertilization of plots. It also carries out specific actions in favor of young people and women, and offers a savings service. Thanks to the latter, 53% of respondents say they save every month, compared with only 25% of producers in the control group.

These actions are the main drivers behind the very high level of supplier satisfaction with the cooperative, which scores highly on the Net Promoter Score, an indicator that compares the number of promoters of an organization (i.e. the number of people who would recommend the organization to their friends and family) with the number of detractors (people who would not recommend the organization to their friends and family). Abakundakawa achieves a very high score (NPS of 51), a testament to the strong satisfaction and loyalty of its members.

These testify in particular:

“They teach us how to make coffee, compost, mulch, prune, weed and renovate the field. All these things that the cooperative teaches us are very important for a coffee grower, because they enable him to improve his growing methods in a professional way. I think it’s something unique that our cooperative has that can benefit all coffee growers.”

Woman, aged 61

“I like the way they value their members and offer training so we can improve the quantity and quality of our produce. They also offer premiums and provide cows for breeding so we can get manure easily.”

Woman, 62 years old

As in the majority of satisfaction surveys linked to the provision of services, the only subject of dissatisfaction remains the price paid, in this case for coffee. 62% of respondents were dissatisfied with the prices paid by Abakundakawa. However, 62% also claim to have made a profit on the last harvest, and half of them have noticed an improvement on last year in terms of income received. In fact, Abakundakawa pays a higher price than the market price, and the premiums from organic and fair trade certification also enable the payment of a bonus at the end of the campaign.

Aware of the crucial contribution made by the cooperative, 80% of those questioned plan to continue investing and developing their coffee production. It’s a safe bet that they will continue to supply Abakundakawa with top-quality fair-trade coffee for a long time to come.